Health January 18, 2026

Switching Health Plans? How to Check Generic Drug Coverage and Save Money

When you switch health plans, your meds shouldn’t suddenly cost three times more. Yet every year, thousands of people find out the hard way that their $5 generic blood pressure pill is now a $40 copay - not because the drug changed, but because the formulary did.

Why Generic Drug Coverage Matters More Than You Think

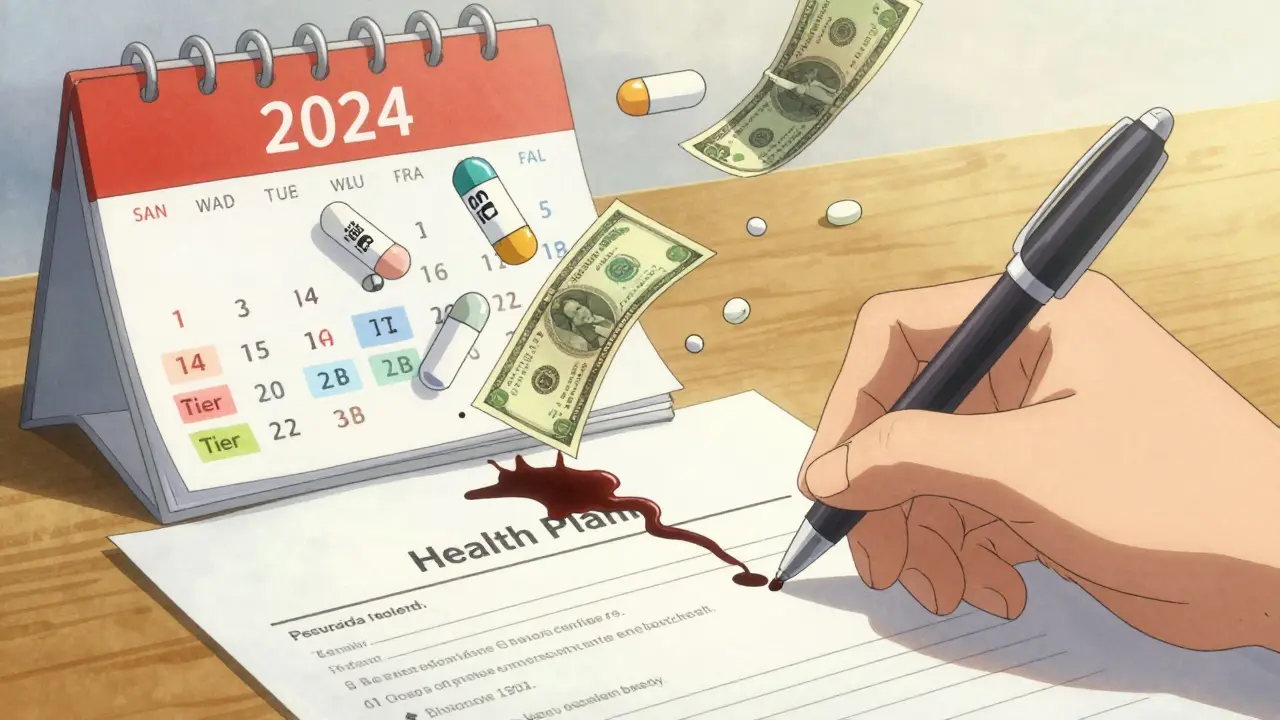

Generic drugs make up 90% of all prescriptions filled in the U.S. But they account for just 23% of total drug spending. That’s because they’re cheaper - sometimes 80-90% cheaper than brand names. But if your new health plan doesn’t cover them well, you’ll pay more out of pocket, even if you’re taking the exact same medicine. Most plans use a tier system to organize drugs. Tier 1 is where you want to be. That’s where the cheapest generics live - often with $3 to $20 copays. Tier 2? That’s usually brand-name drugs or non-preferred generics. Tier 3 and 4? Specialty meds, high costs. If your levothyroxine, metformin, or lisinopril moves from Tier 1 to Tier 2 when you switch plans, you could be paying hundreds more a year.How Formularies Work - And Why They’re Not the Same Everywhere

A formulary is just a list of drugs your plan covers. But here’s the catch: every plan builds its own. Even two plans from the same insurer can have different tiers for the same drug. In the individual marketplace (like Healthcare.gov), plans must follow federal rules. Silver plans with Standardized Plan Design (SPD) are the gold standard for generic users. They waive your deductible for Tier 1 generics. That means even if you haven’t met your $2,000 medical deductible, your $10 generic copay still applies. Non-SPD plans? You pay the full deductible first - sometimes $5,000 - before your generic copay kicks in. Medicare Part D plans are even trickier. The base deductible in 2023 was $505. Most plans charge $0-$10 for preferred generics after that. But some have no deductible at all. Others charge $15 for non-preferred generics - even if they’re the same active ingredient. And then there’s state rules. In New York, many plans cover generics with $0 copay before any deductible. In California, you pay a $85 outpatient deductible first - then 20% coinsurance, capped at $250. That’s a big difference if you’re on three daily meds.What You Need to Check Before You Switch

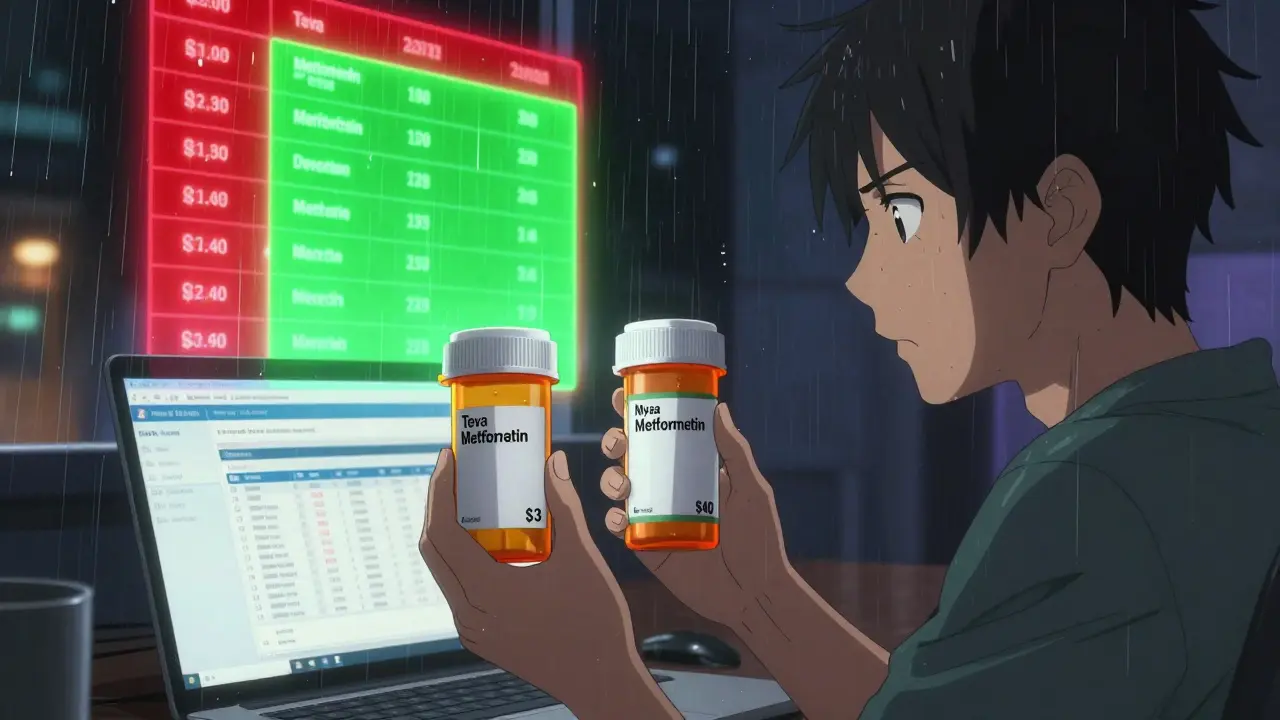

Don’t just look at monthly premiums. Don’t even just look at the “Tier 1” label. Here’s what actually matters:- Exact drug name and manufacturer - Metformin made by Teva might be Tier 1. Metformin made by Mylan might be Tier 2. Same drug, different price.

- Strengths covered - Your 500mg metformin might be covered, but your 1000mg isn’t. That forces you to take two pills instead of one - and pay twice the copay.

- Pharmacy network - Your local CVS might be in-network. But if your plan only offers $3 copays at Walgreens, you’re stuck paying $12 at CVS.

- Deductible integration - Is your prescription deductible separate? Or is it bundled with your medical deductible? Bundled means you pay $3,000 in doctor bills before your $5 generic copay starts.

- Mail-order options - Some plans charge $0 for 90-day mail-order generics. Others charge full retail. That’s a $200 annual difference.

Real Cost Differences: A Quick Example

Let’s say you take three generics: metformin 500mg, lisinopril 10mg, and atorvastatin 20mg. You fill each monthly.| Plan Type | Generic Copay | Deductible Applied? | Annual Cost |

|---|---|---|---|

| Silver SPD Marketplace Plan | $3 per pill | No | $108 |

| Non-SPD Marketplace Plan | $3 per pill | Yes - $2,000 deductible | $2,000+ (until deductible met) |

| Medicare Part D (Preferred Generic) | $0-$10 per pill | Yes - $505 deductible | $505 + $108 = $613 |

| California HMO (with $85 drug deductible) | 20% coinsurance | Yes - $85 deductible | $85 + $108 = $193 |

| New York HMO (no drug deductible) | $0 | No | $0 |

Tools That Actually Work

Stop guessing. Use these tools:- Medicare Plan Finder - Type in your drugs, zip code, pharmacy. It shows exact costs across all Part D plans. Used by over 4 million people in 2022.

- Healthcare.gov Plan Selector - Filter by “prescription drug coverage” and enter your meds. Shows you which plans waive deductibles for generics.

- Insurer’s own formulary tool - Go directly to the plan’s website. Look for “Drug List” or “Formulary Search.” These are 96% accurate - better than third-party tools.

- eHealthInsurance’s calculator - Plug in your drugs and pharmacy. It compares 50+ plans in minutes.

Common Mistakes People Make

Most people think: “It’s a generic. It’s cheap. It’ll be covered.” That’s not true. Here’s what goes wrong:- Assuming all metformin is the same - Manufacturer changes matter. Teva vs. Mylan vs. Sandoz - each can be on a different tier.

- Not checking mail-order prices - Your $15 retail copay could be $0 for 90-day supply. That’s $180 saved per year.

- Ignoring pharmacy networks - A plan might offer $3 copays - but only at CVS. Your local pharmacy? $18. You didn’t switch plans. You switched pharmacies.

- Forgetting to check next year’s formulary - Plans change their lists every January. What was Tier 1 in 2025 might be Tier 3 in 2026.

- Not asking about therapeutic interchange - Your doctor prescribed metformin ER. Your new plan wants you to switch to immediate release. That’s legal - but it can cause side effects.

What’s Changing in 2025 and Beyond

The rules are shifting. The Inflation Reduction Act capped insulin at $35/month - starting in 2023. By 2025, Medicare Part D will cap total out-of-pocket drug costs at $2,000 per year. But the real shift is in formulary design. More plans are splitting generics into two tiers: “preferred” and “non-preferred.” That’s new. In 2023, most plans had one generic tier. In 2026, you might see three: Tier 1A (preferred generics), Tier 1B (non-preferred), and Tier 2 (brand-name equivalents). Experts predict integrated medical and prescription deductibles will vanish from most marketplace plans by 2027. Why? Because people keep getting burned. States like California and New York are pushing for $0 generic copays - and others are following.Bottom Line: Do the Work

Switching health plans isn’t about the lowest monthly premium. It’s about the lowest total cost for your meds. If you take even one generic drug every day, you need to treat your formulary like your budget - with precision. Here’s your checklist before you switch:- Get your current plan’s formulary. Write down every drug, manufacturer, and strength.

- Find the new plan’s formulary. Search each drug by name AND manufacturer.

- Check the pharmacy network. Are your usual stores in-network?

- Calculate your annual cost: copay × 12 × number of drugs. Add deductible if applicable.

- Call the insurer. Ask: “Is this exact version of metformin covered on Tier 1? What if I use mail-order?”

Frequently Asked Questions

What if my generic drug isn’t covered at all in my new plan?

You can request a formulary exception. Your doctor must submit a letter saying the drug is medically necessary and alternatives either didn’t work or caused side effects. Many plans approve these - especially for diabetes, heart, or thyroid meds. Don’t assume it’s denied. Ask.

Can I switch plans mid-year if my drugs get moved to a higher tier?

Only during open enrollment - unless you qualify for a Special Enrollment Period. Common triggers: losing other coverage, moving to a new state, or if your plan drops your drug entirely. If your drug just moves from Tier 1 to Tier 2, you’re stuck until next year. That’s why checking before you switch is critical.

Do all Medicare Part D plans cover the same generics?

No. Each plan has its own formulary. One plan might cover metformin at $0 copay. Another might charge $12. The difference isn’t in the drug - it’s in how the plan negotiates with manufacturers. Use the Medicare Plan Finder to compare exactly what each plan charges for your meds.

Why do two identical generic drugs cost different amounts on the same plan?

Because plans negotiate separate deals with each manufacturer. Even if two metformin pills have the same active ingredient, one might be made by a company that gave the plan a better discount. That’s why you must check the manufacturer - not just the drug name.

Is it worth switching to a plan with a higher premium if it has better generic coverage?

Almost always yes. If you take three generics and your copay drops from $15 to $3, you save $432 a year. That covers a $35 monthly premium increase. Always calculate total annual cost - premium + copays + deductible - not just the monthly bill.

Write a comment

Items marked with * are required.

15 Comments

Erwin Kodiat January 19, 2026 AT 12:45

Just switched plans last month and almost got burned on my metformin. Thought I was golden 'cause it was 'generic'-turns out the manufacturer switched from Teva to Mylan and my copay jumped from $3 to $18. Never again. Always check the manufacturer, not just the drug name.

Christi Steinbeck January 20, 2026 AT 08:29

THIS. I’ve been yelling this from the rooftops since my insulin got moved to Tier 3 last year. People think generics = cheap, but nope. It’s a minefield. If you take more than one med, you’re basically doing tax prep every open enrollment.

Jacob Hill January 20, 2026 AT 23:31

Just to clarify: the Medicare Plan Finder is the only tool that actually works-every other site, including HealthCare.gov’s, sometimes lags by a week or two on formulary updates. I’ve been burned twice by outdated data. Always cross-check with the insurer’s own formulary PDF-download it, don’t just browse it.

Lewis Yeaple January 22, 2026 AT 16:12

It is imperative to note that the formulary structure is not merely a bureaucratic construct; rather, it is a reflection of complex pharmaceutical contracting dynamics between insurers and manufacturers. The tiering system, while ostensibly designed to incentivize cost-effective prescribing, often functions as a de facto gatekeeping mechanism that prioritizes corporate margins over patient access.

Valerie DeLoach January 23, 2026 AT 21:43

I’m a pharmacist, and I see this every single day. Patients come in furious because their $5 pill is now $45. They don’t realize their plan changed the manufacturer preference. I always tell them: ‘Write down the exact brand on your bottle. Bring it to your next enrollment meeting. Ask: Is this exact version covered?’ If they do that, they save hundreds.

Also-mail order. Always ask about mail order. Nine times out of ten, 90-day supply is free or $5. That’s $150 a year saved just by not walking into CVS.

sujit paul January 24, 2026 AT 15:42

Big Pharma and insurance companies are in cahoots. They want you to keep buying pills, not get better. That’s why they make you jump through hoops just to get your $3 generic. They profit from confusion. Don’t trust the system. Always dig deeper. And never, ever assume.

Aman Kumar January 25, 2026 AT 03:43

The systemic failure of the U.S. healthcare infrastructure is epitomized by the formulary labyrinth. The commodification of pharmacological interventions, coupled with opaque contracting mechanisms, renders the patient a passive subject in their own therapeutic regimen. This is not healthcare-it’s financialized pharmaceutical arbitrage.

Lydia H. January 26, 2026 AT 19:40

I used to ignore this stuff until my dad had to switch plans after retiring. He was on three meds. Went from $0 out of pocket to $600 a year. He cried. I cried. Now I help my whole family check every year. It’s not glamorous, but it’s life-changing.

Phil Hillson January 28, 2026 AT 15:42

Why do we even have to do this? Why isn’t this just automatic? Why is my life reduced to spreadsheet hell just to get my blood pressure pills? This system is broken. Someone needs to burn it down.

Josh Kenna January 29, 2026 AT 08:08

Wait so if you’re on a non-SPD plan and you haven’t met your deductible, you pay full price for your meds? Like $200 for a 30-day supply? That’s insane. I didn’t even know that was a thing. I’ve been paying $3 forever-I thought I was lucky. I’m checking my plan right now.

Jackson Doughart January 29, 2026 AT 22:14

One of the most overlooked aspects is therapeutic interchange. My doctor prescribed me extended-release metformin for GI tolerance. My new plan switched me to immediate release without telling me. I had diarrhea for three weeks. No one warned me. Always ask: ‘Can I get the exact formulation I’m on?’

Malikah Rajap January 31, 2026 AT 19:45

Also, if you’re on Medicare, don’t forget to check if your pharmacy is in-network for Part D. My mom switched plans and didn’t realize her CVS was out-of-network. She paid $45 for a pill that should’ve been $5. She didn’t even know she could’ve mailed it in for free. We cried. Again.

Tracy Howard February 1, 2026 AT 23:31

Canada doesn’t have this nonsense. We pay $5 for everything. No tiers. No manufacturer drama. No deductibles. Just walk in, get your pills, leave. Why are Americans so okay with being robbed like this?

Jake Rudin February 2, 2026 AT 19:09

Formularies are the silent tax on the chronically ill. And the worst part? They change every January. You think you’re safe? You’re not. I’ve learned to keep a spreadsheet. Drug. Manufacturer. Tier. Copay. Deductible status. Mail-order option. And I update it every December 1st. Like a religious ritual.

Valerie DeLoach February 3, 2026 AT 02:01

And if you’re on Medicaid or a low-income subsidy, you might be surprised-some states cover all generics at $0, no matter what. Call your state’s Medicaid office. Don’t assume. I had a client in Ohio who thought she’d pay $15, but her plan had a $0 tier for all Tier 1 generics. She was stunned.