Health December 12, 2025

Combo Generics vs Individual Components: The Real Cost Difference

Buying two pills separately might seem like a hassle, but when it comes to cost, it’s often the smarter choice - especially if those pills are generic. Fixed-dose combination (FDC) drugs, which pack two or more medications into one tablet, are marketed as convenient. But convenience doesn’t always mean cheaper. In fact, many branded combo pills cost 10 to 15 times more than buying the same ingredients as individual generics.

Why Combo Drugs Cost So Much

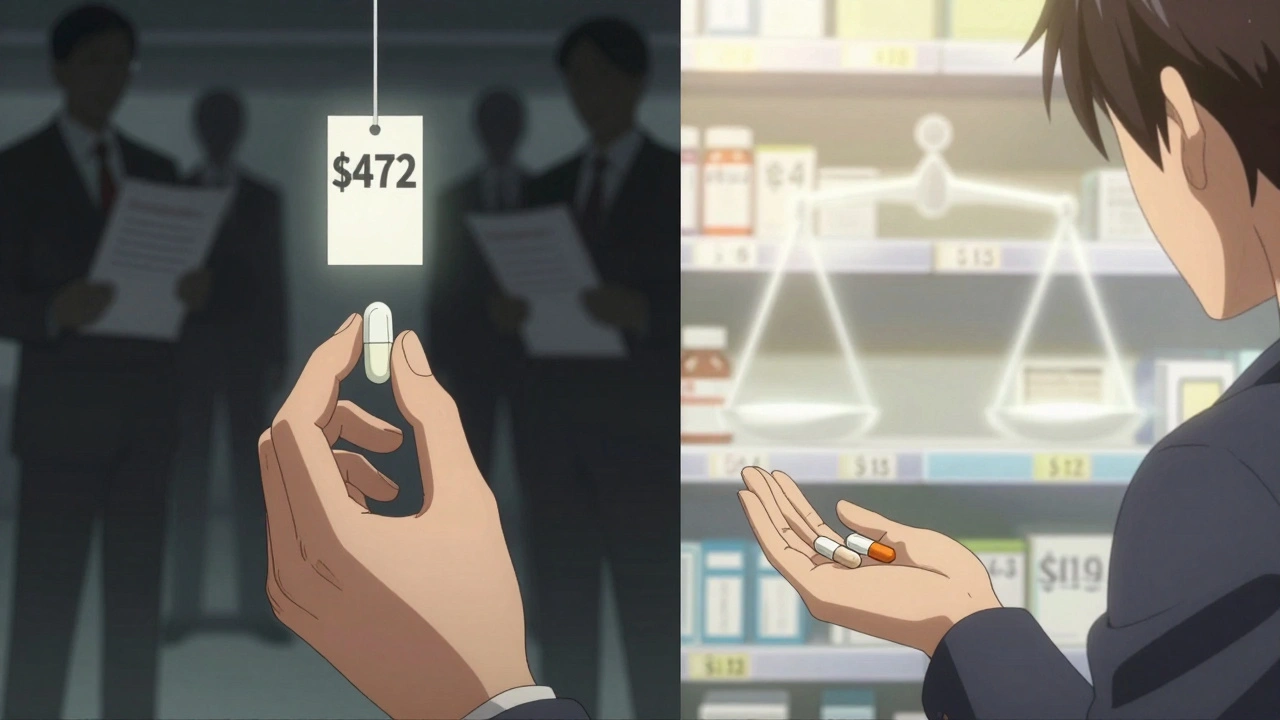

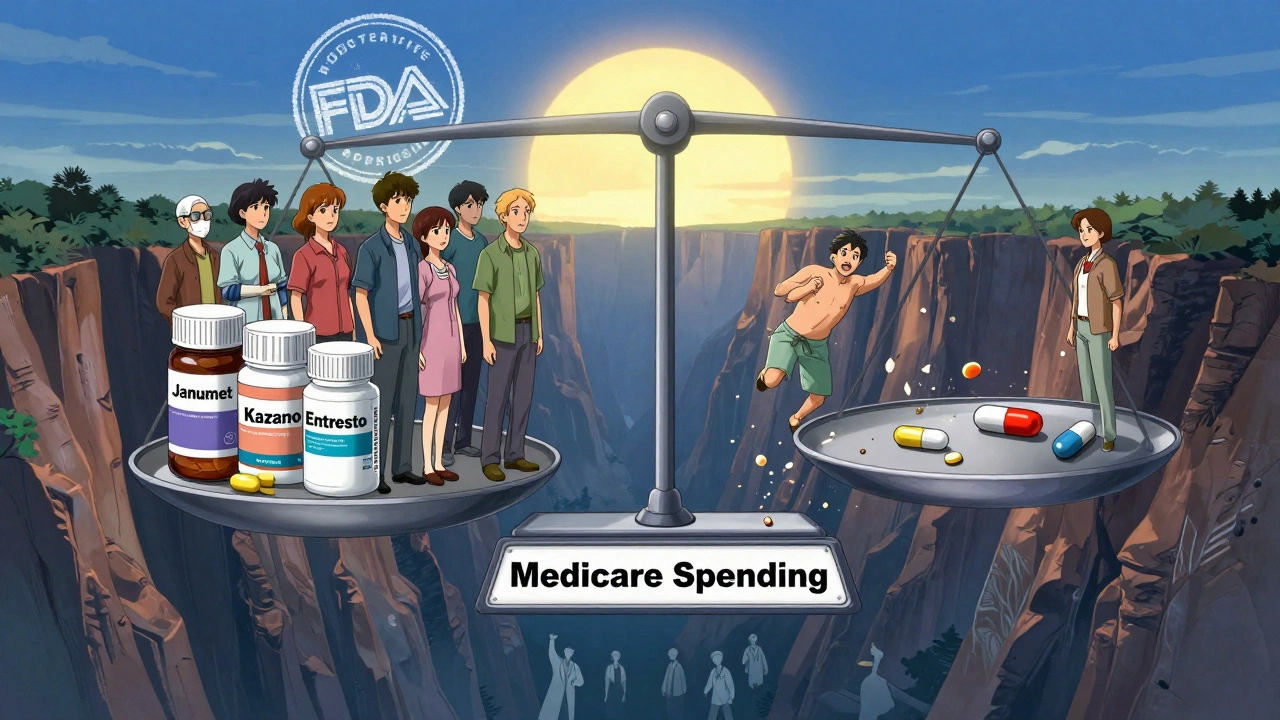

Pharmaceutical companies don’t invent combo pills just to make life easier for patients. Often, they’re a way to extend patent life and keep prices high. When one drug in a combination loses its patent and becomes generic, the other might still be under patent protection. Instead of lowering the price, manufacturers slap the old generic onto the new branded drug and sell the combo at a premium. This is called “evergreening.” Take Janumet, a combo of sitagliptin and metformin. In 2016, Medicare paid an average of $472 for a 30-day supply. Meanwhile, generic metformin cost as little as $4 for the same period at Walmart. Even if you bought the branded sitagliptin separately - which was still under patent - the total would’ve been far less than the combo. The same pattern shows up in Kazano (alogliptin/metformin), which cost $425 a month, while generic metformin ran under $10. A 2018 study in JAMA Internal Medicine found that Medicare Part D spent $925 million more in 2016 on 29 branded combo drugs than it would have if doctors had prescribed the same ingredients as separate generics. That’s not a rounding error. That’s billions of dollars wasted because the system rewards complexity over savings.The Math Doesn’t Add Up

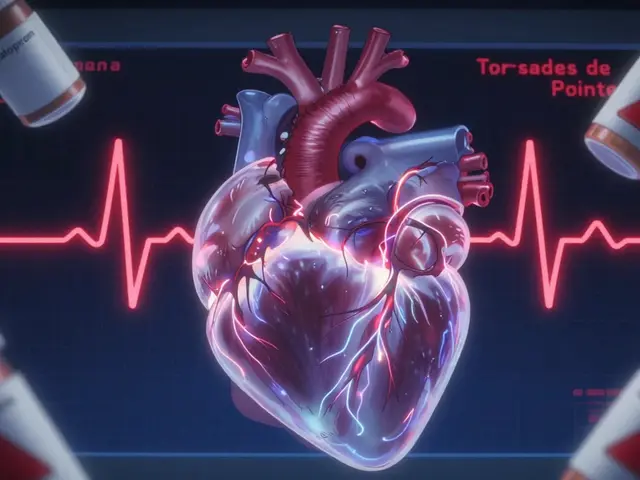

You’d think two generic pills would cost the same as one combo pill with the same ingredients. But they don’t. According to IQVIA, branded combo drugs typically cost about 60% of what two branded pills would cost - but that’s still way above what two generics cost. The formula isn’t 1+1=2. It’s more like 1+1=1.6 for branded versions. But when generics are involved, the ratio breaks down completely. For example, Entresto (sacubitril/valsartan) is a heart failure combo. Valsartan has been generic for years. Sacubitril is still patented. Yet Entresto costs over $500 a month. If you bought generic valsartan and the branded sacubitril separately, you’d save hundreds - even with the brand-name component. Yet most patients get the combo because it’s what’s prescribed, not because it’s the cheapest. This isn’t about innovation. It’s about pricing strategy. Generic metformin has been around for decades. Its price dropped 85% after multiple manufacturers entered the market. But when it’s bundled with a newer drug, that price drop disappears. The combo gets a new price tag - and patients pay the difference.Who Pays the Difference?

You might think, “If Medicare’s paying, why should I care?” But Medicare costs affect everyone. Higher drug spending means higher premiums, higher taxes, or reduced benefits down the line. In 2021, combo drugs made up just 2.1% of prescriptions filled under Medicare Part D - but they accounted for 8.3% of total spending. That’s a massive imbalance. The Congressional Budget Office estimated that over the next decade, Medicare will spend an extra $14.3 billion on branded combo drugs compared to what it would cost to use separate generics. That’s money that could go to better care, lower premiums, or more coverage. Even private insurers are catching on. Sixty-two percent of Medicare Part D plans now require prior authorization for high-cost combos. Pharmacy benefit managers are creating “carve-outs” - rules that block certain combos from being covered unless the patient has tried the cheaper option first. Some plans even offer incentives to switch from combos to individual generics.

Is Convenience Worth the Cost?

Proponents of combo drugs argue that fewer pills mean better adherence. And there’s truth to that. Studies show patients are 15-20% more likely to take their meds regularly when they’re packed into one pill. For people managing multiple conditions - say, diabetes and high blood pressure - forgetting one pill can mean skipping two treatments. The American College of Cardiology found that for certain high-risk patients, combo drugs improved adherence by up to 25%. That’s huge. Missed doses lead to hospitalizations, ER visits, and long-term damage. In some cases, the cost of a combo might be justified by avoided complications. But here’s the catch: this benefit doesn’t apply to everyone. If you’re stable on two separate generics and have no trouble remembering to take them, there’s no reason to pay extra. And if you’re on Medicare or have a high-deductible plan, that $400 combo might mean skipping other essentials - insulin, food, rent.What You Can Do

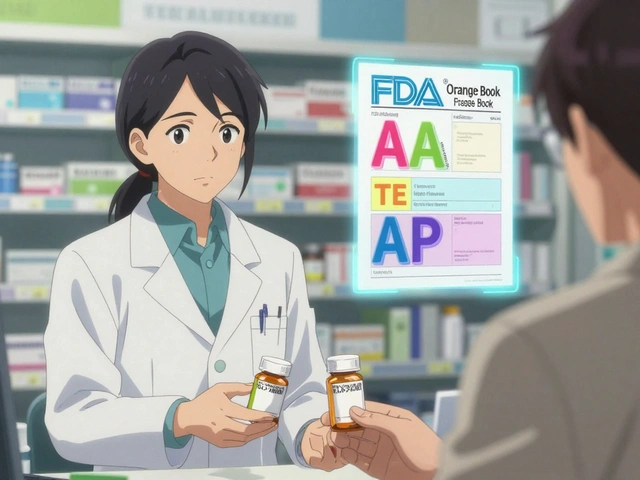

Don’t assume your doctor knows the cost difference. Ask. Say: “Are there generic versions of these drugs I could take separately? How much would that cost compared to the combo?” Check your pharmacy’s price list. Walmart, Costco, and some CVS locations offer generic metformin, lisinopril, and other common drugs for under $5. You can often buy two generics for less than one combo. Use tools like GoodRx to compare prices across pharmacies. Talk to your pharmacist. They’re not just dispensing pills - they’re cost advisors. Many can tell you if your combo is overpriced and whether switching is safe. If your insurance denies coverage for the combo, appeal. Cite the cost difference. Mention that separate generics are therapeutically equivalent. Many plans will approve the switch if you show the math.

The Bigger Picture

The Inflation Reduction Act of 2022 gave Medicare the power to negotiate prices for some of the costliest drugs. That could eventually bring down combo prices - but only if the government targets them. Right now, most negotiated drugs are single-agent brand names. Combos are still mostly off the table. The FDA is also pushing to speed up generic approvals. More competition for individual components means more pressure on combo makers to lower prices. But until that happens, patients are left holding the bag. This isn’t about hating big pharma. It’s about recognizing that the system is broken. We’re paying for convenience that doesn’t exist - because the generics are already there. We’re paying for a pill that does nothing new, just packs old drugs together and charges a premium. The truth? If you can take two generics safely, you should. It’s not rebellious. It’s rational. And in a system where drug prices are opaque and confusing, saving hundreds a month isn’t just smart - it’s necessary.When Combos Make Sense

There are exceptions. Some combos contain drugs that aren’t available separately - like newer dual-action medications for hepatitis C or HIV. Others combine drugs that are unstable when taken apart. And for patients with cognitive issues, dementia, or complex regimens, a single pill can be life-changing. But those cases are rare. Most combo drugs on the market today - especially for diabetes, hypertension, and cholesterol - use ingredients that have been generic for years. If your combo fits that description, you’re likely paying for branding, not benefit. Ask yourself: Is this combo giving me something I can’t get cheaper elsewhere? If the answer is no, it’s worth pushing back.Write a comment

Items marked with * are required.

8 Comments

nina nakamura December 12, 2025 AT 12:14

Stop letting pharma dictate your health choices. Generic metformin is $4. Sitagliptin? $120. Combo? $470. The math isn't hard. You're not lazy for wanting two pills. You're smart.

They profit from your confusion. Don't be their puppet.

Hamza Laassili December 14, 2025 AT 06:42

OMG YES!! I just got my RX for Janumet and was like... wait a minute... why am I paying $500 for THIS?! I checked GoodRx and generic metformin is like $3 at Walmart and sitagliptin? $110!!! I called my doc and they were like 'oh we just prescribe what's easiest'... NO. I switched. Saved $450/month. This is a SCAM. #PharmaFraud

Casey Mellish December 14, 2025 AT 12:51

As an Aussie who's seen our PBS system work, this is why we need price transparency. Here, if a combo drug isn't significantly better than separate generics, it's not subsidized. Simple. No one pays $500 for a pill that's just two old drugs in one.

It's not about convenience-it's about corporate greed. And guess who picks up the tab? The taxpayer. Same in the US. We need to stop normalizing this.

Tyrone Marshall December 15, 2025 AT 06:03

There's a quiet dignity in managing your own health, even if it means juggling two pills. The system wants you to feel guilty for not taking the 'easier' route-but what's really hard is paying rent while your insulin costs $400.

Choosing generics isn't rebellion. It's survival. And if your doctor doesn't get that, find one who does.

You're not broken for needing to be frugal. The system is.

Emily Haworth December 16, 2025 AT 22:12

EVERYTHING IS A LIE 😱

They're putting tracking chips in combo pills to monitor your compliance. I read it on a forum. Your insurance knows if you're taking them. They want you dependent. Also, metformin causes cancer. But the combo? They say it's 'safe'. 🤔

WHO BENEFITS? 💸

They're watching. I know you're reading this. 😈

Himmat Singh December 18, 2025 AT 01:17

It is imperative to note that the economic rationale underpinning the cost differential between fixed-dose combinations and individual generic agents is not universally applicable across all therapeutic contexts. In certain clinical scenarios, pharmacokinetic synergy and bioavailability considerations may render the combination pharmacologically superior, irrespective of pricing structure. One must therefore exercise caution in generalizing this observation to all patient populations.

Webster Bull December 18, 2025 AT 06:38

Two pills. One pill. Same drugs. Same effect.

Why pay 10x?

Simple.

They're rich.

You're not.

Ask your pharmacist.

Do it now.

Donna Hammond December 18, 2025 AT 13:15

I work in a community pharmacy and I see this every day. Patients come in stressed because their combo costs $400 and they’re choosing between meds and groceries. I show them the generic prices-sometimes under $15 total for both. Their face lights up. They say, 'Why didn't anyone tell me?'

It’s not about being hard to take. It’s about being hard to afford. Your pharmacist is your secret weapon. Don’t be shy. Ask us. We know the numbers. We want you to be healthy, not broke.